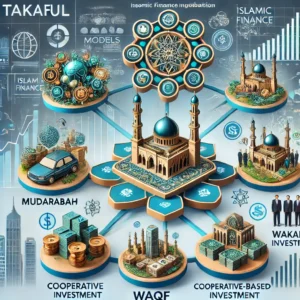

Takaful Models and Their Implementation

Mudarabah Model

The Mudarabah model operates on a profit-sharing basis between the investor (rabb al-mal) and the fund manager (mudarib). It covers underwriting and investment, with profits shared at a pre-determined ratio. The underwriting surplus is the remainder after claims and reserves are deducted.

Modified Mudarabah Model

Similar to the standard Mudarabah model, this version allows Takaful operators to claim a portion of the net underwriting surplus, reinvesting the income into the fund.

Wakalah Model

Under this model, Takaful operators act as agents (wakil), managing funds and earning a fixed fee. The underwriting surplus benefits participants, making it a preferred model in the Middle East.

Modified Wakalah Model

This modified version grants operators a share of the underwriting surplus, agreed upon with participants, ensuring fair profit distribution.

Hybrid Model (Wakalah & Mudarabah)

This hybrid combines Wakalah for underwriting and Mudarabah for investment, allowing Takaful operators to earn fees and a share of investment profits.

Waqf Model

The Waqf model is based on charitable contributions, where funds are donated and managed as a trust. Participants contribute to the Waqf fund, which provides compensation in case of loss.

Saudi Arabian Cooperative Insurance Model

Saudi Arabia follows a cooperative insurance model regulated by SAMA. It mandates a 10% net surplus rebate for policyholders and 90% allocation to shareholders.

Conclusion

Different Takaful models provide various frameworks for Islamic insurance. Their implementation varies based on economic and regulatory requirements.

For more information, visit Islamic Finance.