History of Insurance

Origins of Insurance

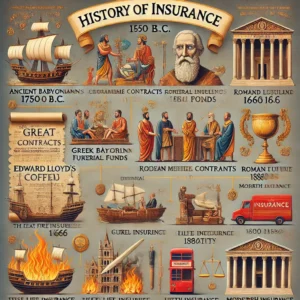

The history of insurance dates back to 1750 B.C. in Babylon, when the first policy or liability system was introduced. According to the Babylonian legal text, a broker would bear the loss if a client’s assets were damaged.

Insurance in Ancient Greece and Rome

The citizens of Rhodes in Greece introduced the concept of maritime insurance, where merchants paid a certain amount to protect themselves against losses. Similarly, the Athenians developed insurance policies to cover higher expenses during winter months or wartime. In Ancient Rome, funeral costs were high, and Romans collectively contributed to cover these expenses.

Guilds and Mediaeval Insurance

During the Mediaeval era, guilds and tradespeople protected their members against financial losses. If a blacksmith’s forge burned down or a carpenter was robbed, the guild would compensate for their losses.

The Birth of Fire Insurance

In 1666, the Great Fire of London, which started in a bakery on Pudding Lane, created the need for professional fire services and insurance. This led to the establishment of fire insurance companies, ensuring landlords and businesses were financially protected.

Edward Lloyd’s Coffee Shop and Marine Insurance

In 1688, Edward Lloyd’s coffee shop became a hub for shipping merchants to share trade information. This led to the creation of Lloyd’s List, a publication for shipping news, and eventually to the formation of Lloyd’s of London in 1871, which allowed collective underwriting of insurance policies.

Development of Life Insurance

In the 1800s, British insurers developed the mortality table to assess life insurance risks. By 1850, approximately 180 insurers provided around £150 million in life insurance. However, fraud led to the first government regulations in the insurance sector.

Reinsurance and Global Expansion

Switzerland introduced the concept of Reinsurance in 1861 through Swiss Re, following the Glarus fire that destroyed two-thirds of the city. Swiss Re expanded its offerings from marine insurance (1864) to health insurance (1881) and motor insurance (1901), becoming a major competitor to Lloyd’s of London.

Modern Health Insurance

The first modern health insurance firm, Blue Cross, was established in 1929 in Dallas. Clients paid 50 cents per month for hospital treatment, including maternity care.

Medical Technology and National Insurance

The 20th century saw rapid advancements in medical technology, increasing the need for health and life insurance. In 1948, Britain introduced the National Health Service (NHS), providing free healthcare for its citizens. Other countries adopted similar nationalized healthcare systems, whereas in the United States, employers began offering health insurance as an employee benefit.